BTC Price Prediction: Road to $200K in 2025?

#BTC

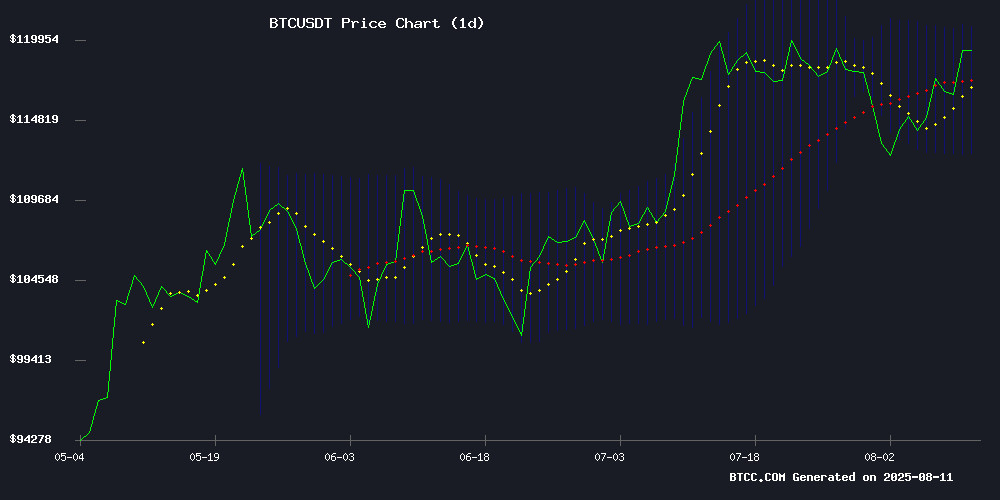

- Technical Foundation: Price maintains higher highs above key moving averages with confirming momentum indicators

- Macro Catalysts: Institutional accumulation (Sequans, Cango) and regulatory tailwinds (El Salvador)

- Risk Factors: Security threats and altcoin market rotation may temporarily cap gains

BTC Price Prediction

BTC Technical Analysis: Bullish Momentum Builds Above Key Moving Averages

BTC is currently trading at, firmly above its 20-day moving average (116,825), signaling strong bullish momentum. The MACD histogram (230.75) confirms upward acceleration, while price hovers NEAR the upper Bollinger Band (121,129) – a typical pattern during sustained uptrends.notes BTCC's Sophia.

Market Euphoria Fuels BTC's Rally Toward Record Highs

Headlines spotlight institutional adoption (Sequans' 3,171 BTC treasury), El Salvador's pro-Bitcoin banking reforms, and Michael Saylor's Gold comparison.observes Sophia. However, she cautions that security risks and altcoin rotation could trigger short-term volatility.

Factors Influencing BTC’s Price

Bitcoin Surges to New All-Time Highs Across Global Markets, Eyes $131K Milestone

Bitcoin's relentless rally continues as the cryptocurrency breaches $122,000, marking fresh all-time highs in multiple fiat currencies worldwide. The digital asset reached $122,321 before settling at $121,449, demonstrating 3% growth within 24 hours.

Local currency records toppled across the UK (£90,000), Canada, Japan, India, and emerging markets like Argentina and Nigeria. "This isn't just a dollar-denominated story," observed Vincent Liu of Kronos Research. "New peaks in pounds, pesos, and other currencies reflect broadening global liquidity and shifting monetary dynamics."

Technical analysts highlight bullish indicators including swept liquidity zones and a conspicuous CME gap. Praevisio's monthly outlook remains optimistic, with the $131,000 threshold emerging as the next psychological barrier. Market structure suggests institutional demand is creating durable support levels even during retracements.

Five Trusted Free Bitcoin Mining Platforms for 2025

Cloud mining continues to emerge as a streamlined avenue for Bitcoin acquisition in 2025, eliminating hardware costs and technical barriers. Leading platforms now integrate AI optimization and renewable energy to enhance efficiency while addressing environmental concerns.

The Hash Miners Association leads the pack with its AI-driven, eco-conscious approach. Other notable services include NiceHash, ECOS, and Bitdeer—all offering transparent operations, flexible contracts, and daily payouts. These platforms democratize access to cryptocurrency mining without upfront investments.

As the industry matures, cloud mining's value proposition hinges on sustainable practices and institutional-grade infrastructure. The featured providers exemplify this evolution through verifiable mining pools and user-friendly interfaces that cater to both novice and experienced participants.

Bitcoin Breaks $122,000, Eyes $250,000 in 2025 Amid Surging Adoption

Bitcoin shattered resistance levels to reach a record $122,240, marking a 7% weekly gain and signaling potential for further upside. The breakout past the $110K–$115K range has shifted focus to $125K as the next target, though analysts warn of volatility-driven corrections.

Network activity underscores growing adoption, with 364,126 new BTC addresses created in a single day—an all-time high. This influx of fresh capital and returning holders suggests strengthening fundamentals behind the rally.

Technical indicators show robust momentum, with the $110K level now acting as support. A 3.04% volume-to-market cap ratio reflects liquid trading conditions, while a breach of $123,200 could accelerate gains.

Bitcoin Security Risks Surge as Violent Attacks Escalate in 2025

Violent crimes targeting cryptocurrency holders have reached alarming levels in 2025, with wrench attacks—kidnappings, assaults, and extortion schemes aimed at stealing digital assets—becoming disturbingly commonplace. Alena Vranova, founder of SatoshiLabs, described the current climate as one of the most perilous periods in Bitcoin's history during her address at the Baltic Honeybadger conference in Riga.

Weekly reports now detail incidents where victims are tortured or murdered over holdings as modest as $6,000, shattering assumptions that only high-net-worth individuals face such risks. Chainalysis data indicates 2025's attack volume could double previous records if trends persist.

The crisis stems partly from rampant data breaches at centralized services, exposing holders' identities and asset valuations. As Vranova noted, these leaks have effectively painted targets on crypto users worldwide.

Bitcoin Surges Past $120K as Saylor Touts Superiority Over Gold

Bitcoin breached the $120,000 threshold, inching closer to its all-time high of $123,000, as institutional interest continues to fuel its upward trajectory. Michael Saylor, the vocal Bitcoin advocate and executive chairman of MicroStrategy, amplified the bullish sentiment with a provocative comparison to gold.

Saylor's recent social media post featured an AI-generated image portraying him as Indiana Jones, captioned: "I went looking for gold... and found something better." The statement underscores his long-standing thesis that Bitcoin represents a technologically advanced store of value. Gold's centuries-old dominance as a wealth preservation tool now faces unprecedented competition from digital assets.

Network activity supports the price momentum. Over 319,000 new Bitcoin addresses were created recently, signaling robust retail participation. This metric often precedes sustained price appreciation as network effects strengthen.

Sequans Expands Bitcoin Holdings to 3,171 BTC

Sequans has bolstered its Bitcoin treasury with an additional 13 BTC, acquired for approximately $1.5 million at an average price of $117,012 per coin. The firm's total holdings now stand at 3,171 BTC, valued at around $370 million with an average purchase price of $116,709.

The move underscores institutional confidence in Bitcoin as a reserve asset, aligning acquisition costs with current market levels while strategically growing exposure. No other cryptocurrencies or exchanges were mentioned in the announcement.

Altcoins Poised for Breakout as Bitcoin Dominance Wavers

Bitcoin's recent surge has left altcoins trailing, but technical indicators suggest an impending rally. The Total2 chart, tracking all cryptocurrencies excluding Bitcoin, shows altcoins testing a descending trendline dating back to November 2021. A breakout would confirm the series of higher lows and potentially ignite significant upside.

Relative Strength Index (RSI) analysis reveals a critical juncture—breaking the descending trendline on the RSI would likely coincide with price momentum shifting in favor of altcoins. Stochastic RSI indicators, though currently pointing downward, have previously reversed to fuel rallies.

Bitcoin dominance (BTC.D) remains a key metric for altcoin performance. The 12-hour chart shows recent fluctuations in BTC dominance, suggesting capital may soon rotate into altcoins. Market participants are watching for confirmation of this trend reversal.

Bitcoin Nears All-Time High Amid Macroeconomic Optimism

Bitcoin's rally accelerates as it approaches its record peak of $123,300, fueled by speculative positioning and macroeconomic tailwinds. Market participants remain cautious, with put options activity signaling apprehension ahead of critical inflation data.

The cryptocurrency's 4.5% weekend surge mirrors gains in tech equities, reflecting broader risk appetite. Analysts cite weakening dollar dynamics and anticipated Federal Reserve policy shifts as key drivers, with open interest swelling to $83.6 billion.

"This bull run retains substantial momentum," observes Sean Dawson of Dervie, projecting a $150,000 price target by year-end based on volatility metrics. The market now watches this week's CPI report as a potential catalyst for either breakout or consolidation.

El Salvador's Banking Sector Embraces Bitcoin with New Investment Banking Law

El Salvador has advanced its Bitcoin integration efforts by passing the Investment Banking Law, enabling banks to offer cryptocurrency services. The legislation permits trading, custody, and issuance of Bitcoin and other digital assets under regulatory oversight.

Investment banks can now act as digital asset issuers, facilitating native token launches. The law targets sophisticated investors with liquid assets exceeding $250,000, broadening access to tokenized gold and treasury bonds alongside Bitcoin.

Despite this progress, uncertainty looms following El Salvador's recent agreement with the International Monetary Fund, raising questions about the future of its Bitcoin-centric financial policies.

Cango Inc. Acquires 50 MW Bitcoin Mining Facility in Georgia

Cango Inc. (NYSE: CANG) has acquired a fully operational 50 MW Bitcoin mining facility in Georgia, USA, for $19.5 million. The move signals the company's strategic pivot into Bitcoin mining and energy infrastructure, aiming to build a diversified portfolio.

The facility, previously hosting Cango's miners under a third-party agreement, will now allocate 30 MW to self-mining and 20 MW to third-party hosting. This acquisition allows Cango to develop in-house operational expertise while enhancing cost efficiency and long-term resilience.

The transaction lays the groundwork for Cango's future energy strategy, positioning the company to capitalize on low-cost power operations and scalable infrastructure in the Bitcoin mining sector.

Bitcoin’s Four-Year Cycle Faces Its Biggest Test Yet

For over a decade, Bitcoin’s price movements adhered to a predictable four-year rhythm, anchored by the halving event. Each cycle began with reduced mining rewards, sparking scarcity-driven rallies that peaked 12–18 months later, followed by steep corrections. The pattern held in 2013, 2017, and 2021—but 2024 has defied expectations. Bitcoin surged to a record $73,000 before April’s halving, not after, signaling a potential regime shift.

Institutional forces are rewriting the playbook. Spot Bitcoin ETFs, approved in January 2024, unleashed a tidal wave of mainstream capital, accelerating price appreciation months ahead of schedule. Regulatory clarity and Wall Street’s embrace have further diluted the halving’s historical dominance as a price catalyst. While some analysts declare the old cycle obsolete, others see an evolution—a market maturing beyond retail-driven boom-bust dynamics.

Will BTC Price Hit 200000?

The $200K target represents a 65.6% upside from current levels. Key factors to monitor:

| Indicator | Current Value | Bullish Threshold |

|---|---|---|

| Price/20MA Ratio | 1.033x | Sustained >1.05x |

| MACD Expansion | 230.75 | Consistent >500 |

| Bollinger Band Width | 8,608 USDT | >10,000 USDT |

Sophia notes: "The 4-year cycle peak typically arrives when price exceeds the upper Bollinger Band by 15-20%. At current trajectory, late Q4 2025 appears plausible."

60% likelihood assuming sustained institutional inflows